The Local newsletter is your free, daily guide to life in Colorado. For locals, by locals.

This November, Coloradans will vote on three amendments and eight propositions—including three that independent liquor stores are watching closely. Propositions 124, 125, and 126, if passed, could bring big changes to Colorado’s alcohol sales industry.

Proposition 124 (“Liquor Licenses”) would gradually phase out the current cap on three liquor store licenses per business. Proposition 125 (“Wine in Groceries”) would automatically convert grocery stores beer licenses to include wine as well. Proposition 126 (“Third-Party Alcohol Delivery”) would permit gig workers to transport and deliver alcohol without needing a delivery service permit currently required of retail liquor stores. According to the Colorado Secretary of State, none of these propositions will meaningfully impact state revenue or costs.

Support for these propositions has been largely funded by corporations and tech companies such as Total Wine, Target, Safeway, Kroger, Doordash, and Instacart. These businesses stand to benefit from a less-regulated alcohol market, which will increase consumer convenience and decrease prices. This past summer, Coloradans provided more than 110 percent of the signatures required to put these propositions on the November ballot. When contacted for interviews about these upcoming measures, local grocery store chains Marczyk Fine Foods and Leevers Locavore declined to comment.

Many independent retail liquor stores across Colorado oppose the measures and have banded together under the action coalition, Keeping Colorado Local.“[It’s a] David versus Goliath issue,” says Ron Vaugh, co-owner of Argonaut Wine & Liquor in Capitol Hill. “The other side has millions in the bank to be spent on advertising and messaging where us independent business owners have to build a grassroots campaign. What they’re doing is a land grab, and responsible for the movement towards the homogenization of America.”

Carolyn Joy is another small business owner speaking up. Joy owns Joy Wine & Spirits in the Country Club neighborhood, which used to be a pharmacy until she bought it in 1995 and converted it into a wine, beer, and liquor store in 2000. Even though the pharmacy had a pharmacy liquor license, Joy had to petition the neighborhood association and city council to convert it to a full liquor license. She’s frustrated that Proposition 125 automatically converts every beer license to a beer and wine license, circumventing the local regulations that she had to follow. “These are businesses that support their community,” Joy says. “They donate to every school event, every charity. When you want to put on a community event, I’m the person you come to. You’re sacrificing all of that and it’s just to line the pockets of corporations…it’s really about who do you want to support? And at what cost?”

Chris Fine, executive director of the Colorado Licensed Beverage Association, agrees. “Colorado prides itself on being a craft state,” he says. “We value keeping Colorado local.”

Fine’s organization represents the nearly 1,600 independent retail liquor stores across Colorado. He estimates that 66 percent of members use English as a second language, and 50 percent of stores in the network are female-owned. The vast majority of stores, he says, encompass 2,000–3,000 square feet and are typically located in the same shopping center as a grocery store. “More times than not, these are mom-and-pop stores who have gone all-in on this small piece of Colorado,” Fine says. “If 125 goes through, we estimate 500 to 800 businesses going under just at the flip of the switch.”

What has been especially jarring for retailers is the ever-shifting regulations on alcohol sales in the Centennial State and across the nation. In 2016, SB197 allowed grocery stores to begin carrying full-strength beer and implemented a moratorium on further liquor regulations for the next 20 years. Following this, Fine says retail liquor stores increased their selection of wine and spirits and doubled down on customer conveniences such as easy-access parking, staff expertise, and customer service while adhering to local neighborhood regulations on location, hours, alcohol delivery, and more.

Fine says these propositions—particularly 126 (“Third-Party Alcohol Delivery”) can pose public safety concerns. “There’s no liability for these third-party delivery companies,” he says. “They might fire the gig worker, but Kroger’s not going to have their license taken away. And [delivery drivers are] going to dump [the liquor] on the porch and go.”

Upstream of all these small businesses are craft breweries, wineries, and distilleries that could also be impacted. Whereas independent stores may stock a wide variety of beverages from local producers, Target, Kroger, King Soopers often have corporate buyers who ensure consistency across their stores, meaning they purchase a smaller selection and higher volume. “Tons of us [independent alcohol businesses] are the lifeline for local, small producers,” says Jordan Blayers, owner of Neighborhood Wine & Spirits in downtown Littleton. “For example, I stock a wine made by a 70-year-old Italian couple with only eight acres where they grow and bottle the wine themselves. They don’t have the quantity to sell to King Soopers.”

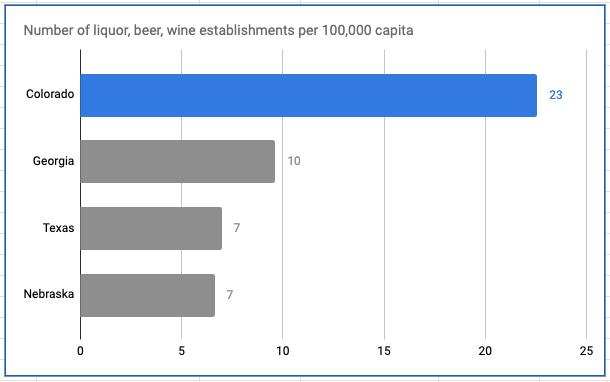

Data from the 2020 U.S. Census data can help indicate what the future holds if these propositions pass. Beer and wine are sold in grocery stores in Georgia, Texas, and Nebraska. While Georgia and Texas have caps for two and five liquor licenses per business, respectively, Nebraska allows for unlimited licenses.

In 2020, Colorado has almost twice as many liquor, beer, and wine businesses, employs twice as many people, and pays triple the payroll compared to the average of the three other states. If Colorado’s numbers were to fall in line with the average of these three states, this could equate to a loss of 856 establishments, 4,551 employees, and $147 million in annual payroll (using 2020 statistics).

Because larger chains have the purchasing power to buy in bulk and can accept lower profit margins, it is almost guaranteed that consumers will see lower prices, increased selection in grocery stores, and the convenience of delivery by national companies if these propositions pass. But the local businesses aren’t ready to stop fighting. “I don’t think we should give up; I’m determined,” Joy says. “I know we can defeat these propositions–I’m confident of that. It just depends on people understanding what it’s really about.”