The Local newsletter is your free, daily guide to life in Colorado. For locals, by locals.

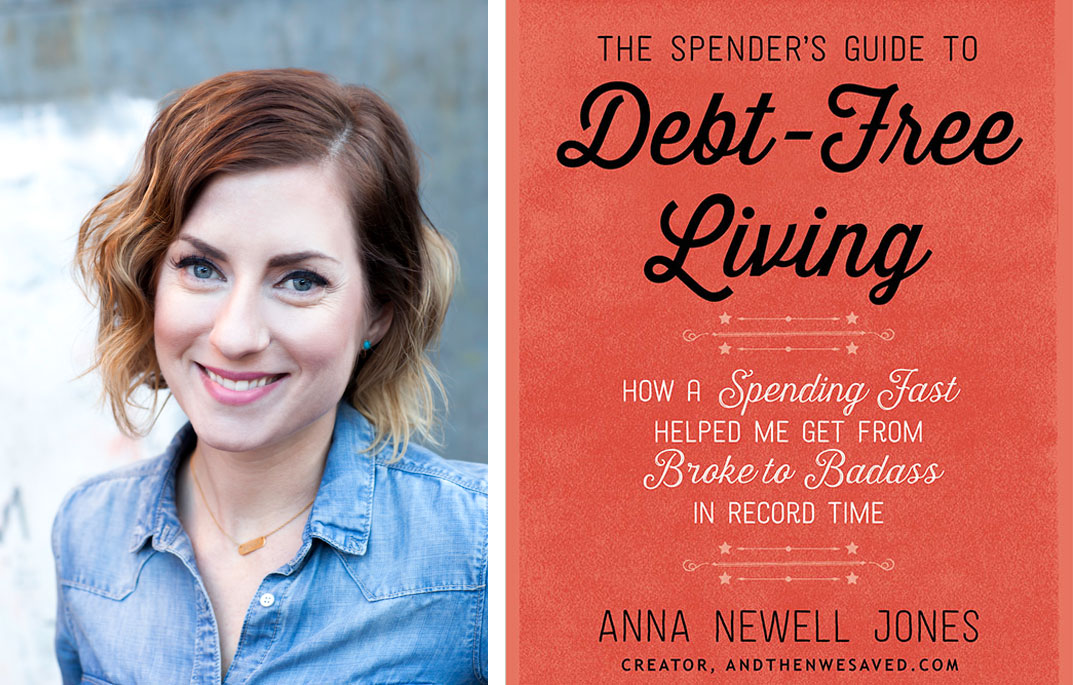

The last time we wrote about Anna Newell Jones (“Cheapskate,” May 2011), she was an up-and-coming blogger at And Then We Saved, chronicling the extreme measures she took to rid herself of $24,000 in debt. Just 18 months later, she was debt free, thanks to a bare-bones lifestyle she has since dubbed—and trademarked—the Spending Fast. Readers of her blog have saved more than $1 million based on her program. Now the mother of a toddler, owner of one Capitol Hill home and one tiny house, her first book, The Spender’s Guide to Debt-Free Living, debuted Tuesday, April 26. Here, Jones talks about the mentality of debt, what to expect from her book, and more:

5280: In a world full of people giving money advice, what niche do you—and now your book—fill?

Anna Newell Jones: When I was in debt, I’d see these people on TV—the Dave Ramseys, the Suze Ormans—and I just couldn’t relate to any of them. They were already rich. As I looked closer, they actually do have rags-to-riches stories, but that showed me I could be someone who talked about money like I needed to be talked to.

What’s been the most inspiring part of leading this charge?

At the end of every month, I ask my readers to send in how much they’ve saved, and I add it up. As of April 6, it’s $1,033,965.51.

Your personality comes through so well on your blog. How does the book compare?

The book, 95 percent of which is brand-new content, is a how-to guide as opposed to the blog, which was about how I was feeling as I was going through getting out of debt. The book cites more experts and research, but it’s still totally my own voice. That part was very important to me. Still, I always say I’m not a finance guru. All I can do is tell you what I did. It is super extreme, and it takes a ton of sacrifice. And I’m not set on my way being the only way.

You’re also going to be on a TV show soon, FYI’s Tiny House Nation.

Yes! The idea was to rent out our place in Capitol Hill and live in the tiny house, or vice versa. But it turns out Denver’s zoning laws are not tiny house–friendly. Once we got cast on the show last year, everything went into hyper-drive. We did the build last fall; and it airs April 30. The tiny house idea was a way to maximize Denver’s crazy real estate market, but we’re not sure how we’ll actually work the tiny house into our lives at this point.

How can people get out of debt and stay out? What mental changes are necessary for success?

A fundamental shift needs to happen where you are content and grateful with what you have and who you are. That takes work, and it’s not something you can do once and call it good. It’s an ongoing process.

What specific things do you do to guard against your old spending habits?

I have to be honest with myself and the people closest to me about my spending habits. I also avoid impulse shopping; getting caught up with what other people have, or spending out of convenience, laziness, hunger, loneliness, anger, happiness, or boredom. I track my spending and continually find new ways to bring in additional income.

What part of being in debt did you find most debilitating?

My credit card debt, $6,000, weighed the heaviest on me. I never would’ve guessed that turning down trips and dinners out would have the type of long-term effect mentally, day to day, five and six years later. But that cloud of heaviness is no longer following me around.

What’s different about your lifestyle now versus when you were in debt?

When I had the debt, I was working at the courthouse and doing photography part-time. Now I don’t have to make decisions because of my debt. That has had such an impact on me, I can hardly describe it.

Meet her: Anna Newell Jones’ book reading and signing takes place May 3 at 7 p.m., Tattered Cover LoDo, 1628 16th St., tatteredcover.com