What is an alternative investment?

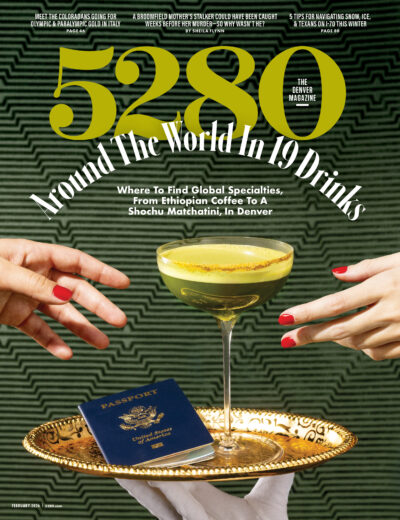

Let’s start by describing what an alternative investment is. Imagine you’re at a dinner party, and everyone is sipping on their classic cocktails—stocks, bonds, and cash. Alternative investments are the funky, unconventional drinks that a few guests know about even though they’re not on the menu. We’re talking about real estate, infrastructure, private equity, hedge funds—it can be a lot of different things outside of traditional investment options.

Finding and vetting an alternative investment can take a lot of time and effort to research the key players. Since these investments aren’t traded on the exchange, it’s important to evaluate the track record of the company or manager behind the investment. For example, if you’re looking at an alternative investment in real estate, consider the track record of the company in purchasing properties that have been profitable when sold again. If the opportunity is in private equity, watch for a history of transforming struggling companies into profitable organizations before sale. These opportunities require a great deal of attention to what’s going on below the surface.

Returns are great, but consider the full picture.

At one time, alternative investments were considered an opportunity that was reserved for the elite. With the introduction of tender offer funds and interval funds over the last decade, this space has been opened up to a much wider pool of investors.

Alternative investments often come with an illiquidity premium. Translation: depending on the investment, your capital could be tied up for years before you can get access to it again. Alternatives may look fairly attractive at first, but it’s important for an investor to fully understand what they’re signing up for.

While we’d all love to stumble upon a unicorn investment—something that has high returns and low risk, that offers full access to our money—you’re generally not going to get all three in an investment. With alternatives, you’re often trading liquidity for potential returns. If you invest in commercial properties for example, and the market isn’t great (tenants are fleeing and properties are vacant), generally if you don’t have to sell that property today, you would want to hold it for the next four or five years to ride out the economic cycle until a more favorable time to sell.

Is this a DIY kind of investment?

Established investors who qualify for alternatives will sometimes have new opportunities put in front of them by friends or family members. The element that is typically lacking in that scenario is the deep level of due diligence that should be conducted as part of an overall investment picture. Think of a registered investment advisor as your financial Sherpa, guiding you through the peaks and valleys of the investment landscape. They are there to do the research and consider how an investment may fit into your unique situation and specific risk profile. We can almost guarantee your cousin isn’t conducting that level of investigation!

And what about first-time investors itching to dip their toes into the alternative investment pool? These opportunities and the potential returns can appear very attractive. However, given the illiquidity of alternative investments, we generally do not recommend the portfolio construction exceed 10-20 percent in alternatives for our clients. While the allure of high returns might be tempting, it’s important not to put all your eggs in one basket. Remember, life happens, and there will be unexpected moments when you’ll want to have quick access to your capital. If the bulk of your portfolio is tied up in alternatives, you may be stuck.

Alternative investments are more accessible than ever.

Access to alternative investments can vary, depending on your qualifications. But the barriers to entry are lower than ever before. With minimums as low as $10,000, the pool of potential investors has expanded quite a bit.

And what about the risks? Alternative investments might sound like you would be taking a big risk by adding it to your mix, but research shows that they can potentially lower the risk profile of your portfolio. As always, it’s important to consider your full financial situation, including your unique goals and risk tolerance, whenever you’re evaluating an investment opportunity.

Is your interest in alternative investments piqued? Not sure where to start? Let’s talk! You can kick off the conversation with our team today.