The Local newsletter is your free, daily guide to life in Colorado. For locals, by locals.

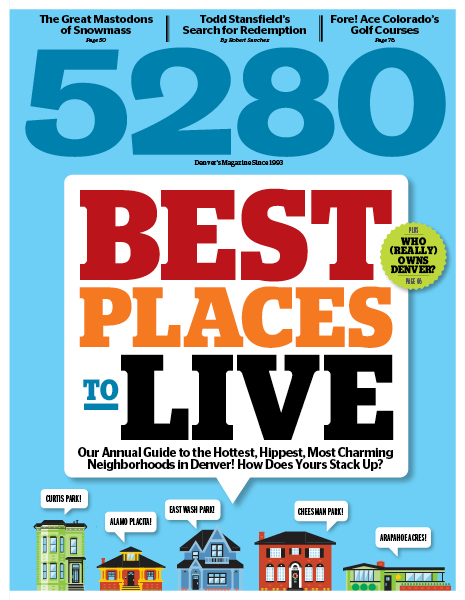

There’s an adage, usually applied to certain Hollywood supernovas, that goes: “I don’t know what ‘It’ is, but so-and-so has it.” That you-know-it-when-you-see-it charisma is what defines this year’s neighborhood guide. As anyone who lives here knows, Denver has an undeniable allure. It’s tempting to attribute that appeal to those glorious peaks we see outside almost every west-facing window, but it’s more than just the mountains. What makes our city exceptional is the city itself and its sturdy cast of surrounding neighborhoods. These urban enclaves showcase Denver’s brawny elegance with everything city neighborhoods should be: walkable, urban, and simply cool, the kind of places that feel simultaneously exclusive, yet welcoming.

But no matter how attractive our neighborhoods are, Denver’s real estate business has endured a drastic, almost violent transformation in the past several years, forcing real estate professionals—at least, the ones who have chosen to remain real estate professionals—to recalibrate how they do business.

It’s more than just figuring out the new rules for securing a loan, or finding tactful ways to tell their clients that their home isn’t worth quite that much anymore. Realty pros are realizing that the way people think about buying, selling, and staying is wildly different than it was not so long ago. “The pendulum is swinging from, ‘What is my investment going to look like in three years?’ to ‘What’s it going to be like living in this neighborhood?’ ” says Ryan Carter, a broker/owner at 8z Real Estate, who focuses primarily on northwest Denver (and lives there as well). “As a broker, my job is now about living the neighborhood’s lifestyle. Not just being a listing agent, but going out to the community events and getting involved with the neighborhood associations.”

Although buyers are still mindful of the acute financial elements of a home transaction, the questions buyers are asking today have begun to revolve around more long-term assessments of a potential home. “People are starting to understand they’ll be in a house for longer than a few years,” says Lane Hornung, 8z’s president and CEO. “They realize that if their home appreciates, great—but it probably won’t make you rich or be your ATM. They’re returning to the simpler concept of real estate being about a place to live and the community around it.”

The increased (though often misleading or incomplete) information buyers and sellers can get on the Internet has made them savvier about the business, but purchasing a home is now about more than just business. Paul Tamburello, a broker/owner at Red Chair Realty and a co-owner of the LoHi complex that houses LoLa, Vita, and Little Man Ice Cream, says factors such as walkability, access to transportation, closeness to downtown, and overall feel now play a much greater role in how people decide where to live. “There’s way more complexity to understanding neighborhoods than there used to be,” he says.

With that in mind, we present this year’s “It” places to live. In many cases, they aren’t even whole neighborhoods, but rather microneighborhoods or even single blocks. We found eight eye-catching city locales, hidden gems that truly stand out because of assets or amenities such as striking architecture; proximity to parks, restaurants, shops, or commercial districts; or active neighborhood associations.

The one thing they all share is that they’re the kind of places that make people want to move in, put down roots, and engage with the people and the community around them. In so doing, they make Denver a more connected and inviting city. “You might be here five or 10 years, so it’s nice to feel like you can extend yourself more,” says 8z’s Patrick Finney. “Get to know your neighbor—what a concept.”

Smart Choices: The New Math

The tumult of the past few years means there are more renters than ever—which actually could be a positive sign for Denver’s growth.

As long as any of us can remember, the much-revered and mythologized American dream revolved around owning a home, and securing a mortgage was as much a rite of passage as getting married or having children.

Like so many other truisms that have crumbled during this long downturn, the wisdom and necessity of home ownership have been recast. Today, more people than ever, motivated by choice or circumstance, are choosing to rent rather than own.

Count Ken Schroeppel among those who think this is a promising trend. Schroeppel is an urban planner at Matrix Design Group and also runs denverinfill.com and denverurbanism.com, two blogs that track and assess local development projects. Schroeppel says the rental vacancy rate in Denver is the lowest it’s been in about 10 years, due mostly to the influx of people who have endured foreclosures or, for whatever reason, just aren’t ready to buy. He also says several new construction projects downtown are likely to be rentals rather than for-purchase condos. “When you look at other cities with substantial downtown populations, the rental market is the majority,” he says. “So this trend is not necessarily a bad thing for us. It could be a sign that Denver is on its way to becoming a more urban city.”

Renting vs. Owning

Which way should you go?

Most economists agree that deciding whether to rent or buy should be based on factors such as how quickly home prices and rents are rising, and how long you plan to stay in a home if you do buy. Denver’s rent ratio—the purchase price of a house divided by the annual rent of a similar house—went from 25.6 in 2005 to 22.5 in 2009. (A ratio around 15 or lower is considered to be pro-buyer, and anything above 20 is pro-renter.) So unless you’re planning to stay here awhile, renting might not be a bad option. The New York Times offers an easy-to-use calculator that helps you figure out what will best fit your needs: nytimes.com/interactive/business/buy-rent-calculator.html

Difficult Decisions: Selling Yourself Short

Avoiding the tough questions about a possible foreclosure? There may be another way out of your predicament.

Although the front range real estate market has positive long-term prospects, we’ll have to endure more pain before reaching the promised land. Real estate research firm Clear Capital released a report in January that projected average home prices in Denver to shrink by 6.6 percent in 2011, following a 4.4 percent dip in 2010, slightly worse than the national average of 4.1 percent.

The results placed us 40th out of 50 metro areas surveyed, and a portion of the blame for this goes to our continuing foreclosure crisis. Colorado had the ninth-most foreclosure filings per household as of February 2011, and even though these dropped from about 46,400 in 2009 to about 42,700 in 2010, an 8 percent decrease, that slowdown may have more do to with confusion over the process, and with pending changes to it, than to an impending turnaround.

All over Denver, foreclosure-eligible properties often far outnumber the ones that are actually in foreclosure (see chart below). The discrepancies arise from uncertainty about when or whether a bank might begin foreclosure proceedings, or a sense of shame over being stuck in a precarious financial position, making distressed property owners slow to act on their options. But certain owners can escape the foreclosure nightmare altogether by trying the next-best alternative: the short sale. This occurs when the homeowner, in cooperation with the lender, sells a property for less than the outstanding balance on the loan. Everyone involved takes a financial hit, but it’s less of a setback than a foreclosure would be. “We brokers should be negotiating more short sales,” says Synergy Real Estate Team’s Joe Phillips, who specializes in distressed deals. “Right now about 70 percent of people with a distressed property just do nothing and let it go back to the bank.”

As with a foreclosure, a short sale negatively impacts your credit rating, though not as drastically. It lowers your deficiency—the difference between the sale price of your property and what you owe—and lingers on your credit report for less time. “A foreclosure can hurt you for about five years, but a short sale will be on your record for closer to two,” Phillips says. “Foreclosures hurt you not only when applying for a loan: A lot of employers now use credit checks when hiring, and if you have a job that requires security clearance, it could hurt you there.”

Phillips says those facing possible foreclosure should find a Certified Distressed Property Expert, a formal credential that real estate agents can obtain. It’s definitely worth exploring whether a short sale is right for you, because delaying the pain is a bad idea. So don’t be shy. “There’s a huge list of benefits [to short sales],” Phillips says. “I’m not sure if people don’t know about them or are just afraid to ask for help.”

Urban Planning: If You Build It…

How the construction of three simple bridges revamped an entire side of town. plus, where similar efforts around denver might produce equally spectacular results.

Denver has many wonderful neighborhoods, but too often they’re islands that require a car or bus trip to get from one to the other. Northwest Denver has been around since streetcars were chugging up the Zuni Street hill, and 15th Street has ushered drivers and pedestrians to and from downtown for a century or so. But what we now call Highland didn’t become Highland—Denver’s smaller-scale, homey, and hip answer to Brooklyn—until the city built three simple but picturesque bridges that provided the practical (and psychologically pleasing) link between northwest Denver and LoDo.

The three spans sit in an almost perfectly straight line from west to east. The Highland Bridge runs across I-25 and offers a pedestrian- and bike-friendly width absent from the narrow freeway-crossing 15th Street sidewalks. The simple wood-and-steel Platte River Bridge sways gently under your feet (or bicycle tires) as it ushers you to and from Commons Park. And the striking Millennium Bridge—the world’s first cable-stayed span—enables walkers and bikers to trek up and over that last stretch to downtown without getting drilled by a passing freight train.

These projects transformed northwest Denver, particularly the suddenly booming LoHi neighborhood. “Because of the bridges, the whole area around 32nd and Tejon has become this awesome little mecca,” says Ken Schroeppel, a Denver-based urban planner, who was so enchanted by the developments that he bought a condo at the western end of the Highland Bridge. “Now you can walk from the state capitol to [LoHi] along this pedestrian-oriented street.”

Home Improvements

As other similar projects take hold around town—such as the widening of sidewalks and elimination of automobile lanes along 14th Street, and the pedestrian-friendly makeover around Civic Center Park—we got to thinking about where such efforts could improve the flow between neighborhoods in other parts of Denver. Here, our brainstorms:

- First Avenue, Cherry Creek

A pedestrian bridge that ran above the hectically multilane artery would move people more freely between the Cherry Creek Shopping Center (and its nearby bike paths) and Cherry Creek North. - Park Hill and Stapleton

These two evolving and new-urbanist-friendly neighborhoods should be cozier but are separated by the perilously traversable Quebec Street. Another pedestrian/bike bridge or safer crosswalks would free up commuting—and commerce—in both directions. - Highland

A long-debated light rail line running along 38th Avenue would enhance that street’s sometimes shabby commercial properties, decrease auto traffic, and enhance an already terrific neighborhood. (The planned streetcar revival along Colfax Avenue would have a similar effect by improving the street’s perpetually downtrodden pockets.) - Uptown

The already hopping 17th Street would truly shine if we replaced the underdeveloped (and over-parking-lotted) gaps along the street with more bike lanes, widened sidewalks, and developed mixed-use properties to fill in the dead spots between downtown and City Park.

Q&A: Not So Fast

Although the days of widespread fix-and-flips are over, they aren’t quite dead for those who know how to play the market just right. Patrick Finney of 8z Real Estate explains how to figure out whether you should dive in or steer clear of this still-volatile space.

5280: Where do fix-and-flip opportunities currently exist in Denver?

Finney: Because there has been little or no new construction going on in Denver proper since the real estate fallout, many general contractors are scrambling to find work in the fix-and-flip arena. This is causing an extra supply of contractors competing for flips. The flips that are selling are in the lower price points, especially under $300,000. From $300,000 to $400,000 is decent, and from $400,000 to $500,000 is a bit tougher. At $500,000 on up, it takes a lot longer for homes to sell—those homes are much riskier for flippers. If you can’t buy, renovate, and resell a home within six to nine months, you’re taking too long.

5280: What else besides price should potential “flippers” be aware of?

PF: Any flipped home done with quality workmanship at a competitive price will stand out, and will most likely blow away a similarly priced nonrenovated home because of amenities and improvements such as open layouts, new kitchens, nice landscaping, or wiring a sound system throughout the home. These improvements come at a slight premium, but most people are willing to pay it while interest rates are so low. An extensive remodel on a nonrenovated property could end up being well over $100,000. Most buyers simply don’t have that kind of cash, the expertise, the time, or the patience to do this work.

5280: If the fix-and-flip market improves, would that open it back up to everyone?

PF: No. A few years ago, anyone could flip a home and get away with inefficiencies and lower-quality work. A seasoned flipper who buys low, puts in the upgrades, and prices it appropriately will sell a flip faster than a regular home is likely to sell. But because buyers have more selection at lower prices, only the best flippers will make it. As will the ones who have deep pockets, in the event a home takes longer to sell.

5280: So what’s the long-term fix-and-flip outlook?

PF: With lower home prices and interest rates, many buyers will pick a completely overhauled home with all the bells and whistles to avoid repair work in the future and the so-called “Home Depot” second mortgage. As long as interest rates stay low, things should remain good for seasoned flippers and the buyers who want flips.

East Washington Park

Microhood: South Gilpin Street between Arizona and Mississippi avenues

Why: No question about it—some of the homes that ring Wash Park are among Denver’s crown jewels of real estate. On the other hand, the sheer volume of foot, car, and bike traffic the park receives must be a bit of a headache for the locals now and then. For less bustle and (a little) less dough, go one block off the park to South Gilpin, where the homes are luxurious without being ostentatious. The east side of the street has more original, smaller brick bungalows than the west side’s scrape-laden lineup, but they all blend together in a tidy, tasteful package. And the nearby park means residents sometimes have such charming local color as geese strolling by to nip at their lawns. “This is still one of Denver’s classic, established neighborhoods,” 8z’s Finney says. “You’re close to the park; Old South Gaylord with its eateries, yoga studios, coffee and bike shops; and Bonnie Brae Ice Cream.”

Stats: (East Washington Park) Average sale price $581,000, -14.2 percent over January 2010

South City Park

Microhood: Steele Street between 16th and 17th avenues

Why: The revitalized City Park area has been drawing new crops of hipsters and professionals for the past several years, which in turn has freshened up the once-seedy, still-gritty, but ever-evolving Colfax Avenue corridor. This block spills right into the park and features a picturesque collection of Denver Squares, brownstones, and a high-rise apartment building called Montview Manor, all on lots that are set back from the curb. The street itself is wider than most north-south blocks in this neighborhood, giving it a more open and pleasing airiness. “This area has a true ‘heartbeat of the city’ feel to it,” says 8z Real Estate’s Patrick Finney.

Stats: (City Park) Average sale price $361,000, +1.4 percent over January 2010

Hilltop

Microhood: Glencoe Street between Third and Fourth avenues

Why: This gently curving street is wide and quiet, and the grandly appointed homes—the scrapes and midcentury houses seem like they’ve stylishly co-existed forever—fill up their lots and reside somewhat snugly together. But rather than appearing cramped, the layout suggests a strong sense of community compared to some of the more spacious and suburban-feeling surrounding blocks. What’s more, Glencoe feeds right into the charming Robinson Park and the tony Denver Tennis Club, giving the street a vibe that’s both elite and inviting. “I think at one point many sellers truly believed they could get Malibu pricing in this area,” says Liz Richards, a broker with Kentwood City Properties. “But after an abysmal few years, we’re finally seeing movement in this area, thanks to strategic price drops and pent-up demand.”

Stats: (Hilltop) Average sale price $761,000, -9.1 percent over January 2010

Five Points/Curtis Park

Microhood: Curtis Street between 25th and 30th streets

Why: This historic district has a colorful mix of hipsters and yuppies, as well as a few dozen spectacular and surprisingly well-kept brownstones, bungalows, and Victorians reminiscent of old San Francisco. This five-block section sits in the rapidly developing corridor between downtown and the burgeoning Five Points commercial and arts district (and its light rail line) and has easy access to freeways. As the heat from downtown’s core spreads north and east, many real estate professionals have pegged this area as Denver’s next hot neighborhood. “This area will be a great mid- to long-term opportunity,” says 8z’s Ryan Carter. “The area around the Welton Street business district is poised to become another Platt Park or Highland-type neighborhood.”

Stats: (Five Points) Average sale price $283,000, +14.9 percent over January 2010

Lower Highland (LoHi)

Microhood: Shoshone Street between 33rd and 34th avenues

Why: The difference between Shoshone’s scrapes and others is that the former don’t look like they were airlifted in from a suburban subdivision; they blend perfectly with the renovated older homes (mostly bungalows) to give the area a lived-in vibe. And the block is just steps away from Denver’s hottest bar and restaurant area; LoHi seemingly has its own tractor beam, pulling in new businesses and residents by the barrelful and creating the kind of destination that’s beginning to draw national attention. “The neighborhood is booming,” says Kentwood City Properties’ Liz Richards. “There’s a bigger drive than ever for new construction since most of the past inventory has been absorbed, and the walkability combined with its culinary notoriety continue to make this a very in-demand hot spot.”

Stats: (Highland East) Average sale price $317,000, +12.2 percent over January 2010

Alamo Placita

Microhood: Emerson Street between Speer Boulevard and Fourth Avenue

Why: Tucked into a cozy triangle just off the perpetual hum of Speer Boulevard, Alamo Placita was the home of legendary Denver Mayor Robert Speer in the late-1800s and of future Colorado Governor Richard Lamm in the 1960s. The small park at the historic district’s center is ringed by simple yet elegant bungalows, along with more modern apartment buildings and condos. The area is a short walk from Governor’s Park and the emerging collection of restaurants and shops along Sixth and Seventh avenues; it offers a quick getaway to downtown via Speer and the Cherry Creek trail; and it’s closer to the city than Wash Park, but with lower prices.

Stats: (Speer) Average sale price $335,000, -2.3 percent over January 2010

East Cheesman Park

Microhood: Race Street between Eighth and Ninth avenues

Why: This stunning street is just steps away from the placid Cheesman Park in the Morgan’s Subdivision Historic District. The homes sit on unusually large lots for this part of town and are an appealing mix of classic and modern, many of them enhanced with strikingly detailed trim and unique window treatments. Given the street’s serene location and nearness to several commercial districts and parks—not just Cheesman—this might be the nicest block in central Denver.

Stats: (Cheesman Park) Average sale price $429,000, -8.2 percent over January 2010

Arapahoe Acres

Microhood: East Cornell Avenue between South Marion and South Franklin streets

Why: This stunning enclave is technically an eyelash over the city line, in Englewood, but we’re claiming it anyway, because it might be the metro area’s most distinct neighborhood. Arapahoe Acres was the first post-World War II residential subdivision to be listed as a historic district. Its Frank Lloyd Wright–inspired homes evoke images of Art Deco masters and California sunshine, and most of the earth-tone houses are adorned with modern art sculptures in their yards. The area even has its own stylized street signs. Just minutes from the University of Denver campus, this neighborhood is the most arresting and unusual setting south Denver has to offer.

Stats: (University) Average sale price $308,000, -3.4 percent over January 2010