The Local newsletter is your free, daily guide to life in Colorado. For locals, by locals.

Today’s 24-hour news cycle wouldn’t be complete without at least a passing reference to interest rates (still near all-time lows), inflation (still sitting at about two percent, right where the Federal Reserve likes it), and job growth (still creeping up, slooooowly). But how much do these standard economic measures really mean to our daily experiences? We wanted to get a little closer to the heart of Denver’s money matters, so we decided to examine on-the-ground economics like the changing value of your home (good news!), the cost of daycare (not-so-good news), and insurance (neither good nor bad news). Plus, we indulge in a few financial fantasies, such as what it’s like to win the lottery. Along the way we hope you’ll glean a better understanding of what Denver’s financial landscape really looks like—and how you can improve the view in yours.

Lost and (Not Yet) Found

The state is sitting on nearly $1 billion in unclaimed money. Is some of it yours?

We’ve all experienced the giddiness of finding a forgotten $20 bill in a ski jacket pocket or stuffed into the love seat, but $800 million? That’s the amount of scratch in the state’s metaphorical couch cushions, waiting to be claimed by Colorado citizens. The treasury’s Great Colorado Payback program reunites Centennial Staters with their missing cash, payroll checks, insurance funds, family money, stocks, and bonds—to the tune of $30 million every year.

We’ve all experienced the giddiness of finding a forgotten $20 bill in a ski jacket pocket or stuffed into the love seat, but $800 million? That’s the amount of scratch in the state’s metaphorical couch cushions, waiting to be claimed by Colorado citizens. The treasury’s Great Colorado Payback program reunites Centennial Staters with their missing cash, payroll checks, insurance funds, family money, stocks, and bonds—to the tune of $30 million every year.

Established in 1987, the program requires estate executors, insurance companies, stock fund managers, and other businesses and organizations left holding unclaimed funds or property to turn them over to the state treasury, which holds them in safekeeping until an heir comes calling. “The money stays on the books forever with their names on it,” program director Patty White says. “If John Doe dies, his children can claim it. The state never takes claim.” Of course, while the state waits for someone to pick up the moola, it grows interest on the principal in an investment fund, some of which has been allocated to boosting tourism efforts and padding the state’s health fund for the uninsured.

Not all of the loot that’s handed over comes in the form of greenbacks and savings bonds, though. White says the state has received everything from safe deposit boxes with house deeds, personal notes, and grocery lists to a custom-made Tiffany necklace worth a couple hundred thousand dollars. (Interestingly, Colorado was the last state in the nation to implement an unclaimed property law. Before 1987, all of the misplaced pennies were either written off or funneled to surrounding states that did have lost property laws.) “We collect about $60 million to $65 million each year,” White says. But only about half that amount is claimed. Of course, every now and again, larger sums find their ways to their owners. In fact, in 2007, a Fort Collins man recovered more than $500,000 from CD investments that had matured but had never been collected.

To find out if you’ve got an unexpected payday coming, visit the Payback website (greatcopayback.com) and search for your name. If you discover a fat stash with your name on it, don’t go quitting your day job right away: It can take as long as six months (sometimes longer with stocks) for the money to find its way back to you. —Lindsey R. McKissick

It’s In The Bag

How an impulsive decision to buy a lottery ticket changed one Aurora family’s life.

In this fashion-forward era of enormous purses, women have grown accustomed to losing small items in the cavernlike spaces: lipstick, loose change, car keys, or, in the case of Colorado native Lenora Flores, nearly $6.4 million. An occasional lottery player, the then 51-year-old Aurora resident decided to try her luck when the Colorado Lottery jackpot crested $5 million last July. She bought 10 quick-pick tickets from her neighborhood King Soopers—and promptly forgot about them. Two weeks later, she found them in her purse, checked the numbers, and nearly fainted. “When I went to the lottery office, they were like, ‘Where have you been?’ ” Flores says, explaining that winners have only 180 days to claim their prizes.

The timing couldn’t have been better. Flores’ husband, Hector, owned a painting business, but it was struggling; Lenora had recently returned to school for a degree in hospital administration in hopes of bringing in more money. In the interim, they weren’t able to pay their bills on time. The couple was $100,000 in debt when they hit the literal jackpot. One day after she discovered the winning ticket in her purse, Lenora walked across the underground parking lot at the Colorado Lottery office with a comically large check for $3.2 million (the couple opted for the lump sum in lieu of annual payments of about $160,000, minus taxes, over 24 years). Ten days later, on Hector’s 57th birthday, the money cleared the bank.

The first thing the Floreses bought? Homes for their adult son and daughter. “We never wanted our kids to struggle the way we did,” Lenora says. Next, she paid off all of their debt. She also bought a house just blocks from her daughter’s and several cars: a work van and a truck for her husband (Hector likes to work, so he kept his painting business), Subarus for their children, and a brand-new Lexus RX 350 for herself. “You know how everybody has these dream cars? That’s what the Lexus was for me,” Lenora says. “When I look at it now, that’s the only thing I feel like I kind of splurged on.”

With the rest of the $3 million (the Floreses have about $200,000 left today), the couple invested in a retirement fund, a college savings account for their four-year-old grandson, and little luxuries, like a bedroom set—and a new Michael Kors purse. It’s much smaller than her old one, so Lenora, who now plays the lottery weekly, won’t lose any more ticket stubs. —Jerilyn Forsythe

Home Sweet Home

We trace the median home value in Denver from 1940 to today—then convert it to 2014 dollars to see just how well (or not) our investments have panned out. —Drew Grossman

Living On Less

One local writer tries to live on minimum wage for a week—and lasts three days.

As a freelance writer, I already survive on less than most people I know. So when 5280 asked me to live on minimum wage for a week, I didn’t think it’d be that difficult. After all, I’d survived on beans and rice in college; I could do it again. I forgot, though, that back in those days I wasn’t paying $2.49 per can for organic azuki beans from Whole Foods. In fact, wandering the aisles at the all-organic store, I realized nearly everything on the shelves seemed beyond the reach of my $132-a-week budget.

I’d arrived at that figure by calculating my monthly income ($1,280 a month if I worked a full-time job at Colorado’s minimum wage, $8 an hour) minus almost 20 percent for state and federal taxes and $500 for my portion of the rent and utilities in a shared house. I made all the obvious cutbacks: no pedicures, eating out, or yoga classes. I stopped using my car; it’s easy to get around Boulder by bike. None of these exclusions were terribly difficult to bear, at least not in the short term. I could still do my favorite things—spend quality time with friends and recreate in the great outdoors—regardless of cash flow.

Eating organically and locally, though—one of my core values—was basically impossible. For me, the predicament was temporary, but as I left Whole Foods having not purchased anything, I pondered the hardship this places on families who must regularly sustain themselves on minimum wage. Even though we all know those organic apples and grapes are healthier snacks for parents and their kids than, say, McDonald’s or the high-fructose (but low-cost) treats in the snack aisle, minimum-wage paychecks don’t stretch far enough to cover them. The situation left me feeling disheartened.

On day three, my funk turned to panic. I hadn’t accounted for my cell phone or Internet bills. Then my parakeet ran out of food. I biked to Petco only to find that a bag of birdseed costs $29.99. The purchase put me dangerously close to blowing my budget. My boyfriend tried to help by inviting me over for dinner, but I felt like I couldn’t show up without something. What could I possibly offer when I had less than $5 to spend?

As I passed the new Trader Joe’s on my way to his place, inspiration struck—Two-Buck Chuck. I squeezed my mountain bike’s brakes. Inside the store, I asked a sales associate to point me in the direction of the vino. He said they didn’t carry alcohol, but the Cherry Creek store did. Denver. I didn’t have time to bus to Denver, and besides, the round-trip ticket would cost five times as much as the wine. Then the kicker: “But it’s not even $2 anymore,” the sales associate said. “It’s $3.” —Jayme Moye

Do Not Drive From Boulder (And Other Commuting Advice)

This spring, the Denver Regional Council of Governments launched a new website, mywaytogo.org, that lets you easily compare the time and cost of getting to work by car, bus, and bike (and also sign up for car and van pools). We examine four common routes to discover the real (monthly) cost of your metro-area commute. —KC

What’s In Your Wallet?

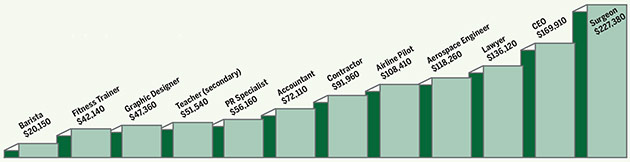

A look at the pay slips for several professions in Colorado. —J. Wesley Judd

Busking Blues

Two part-time musicians learn some important lessons about what it takes to earn their keep (and their dinner) as street performers.

When I formed the band JacknaRound with my guitarist buddy Matt “Action” Jackson eight years ago, we weren’t expecting it to feed our families—maybe just our beer habit and our egos. But when presented with the opportunity to see if we could sing for our supper by busking, well, that whole ego thing came into play. So on a blistering summer afternoon, we headed to the 16th Street Mall to warm up like any proper rockers would: with a couple of beers. Then, guitar cases in hand, we strolled, nerve-free, up the mall to find a lucrative, high-traffic spot to set up. We didn’t get very far.

At the corner of Arapahoe and 16th streets we watched a police officer chase off a fellow musician jamming in front of Tokyo Joe’s. Turns out, the officer informed us, you need a permit ($75 and available through the Denver Department of Public Works) to play music on the streets of Denver. Plainly a supporter of the arts—or at least sympathetic to our quest—the officer also noted that only a handful of locations actually enforce this rule. He kindly directed us across the street from the Daniels & Fisher Tower to an open seating area near Biker Jim’s sausage stand.

At the corner of Arapahoe and 16th streets we watched a police officer chase off a fellow musician jamming in front of Tokyo Joe’s. Turns out, the officer informed us, you need a permit ($75 and available through the Denver Department of Public Works) to play music on the streets of Denver. Plainly a supporter of the arts—or at least sympathetic to our quest—the officer also noted that only a handful of locations actually enforce this rule. He kindly directed us across the street from the Daniels & Fisher Tower to an open seating area near Biker Jim’s sausage stand.

The officer didn’t stick around for our opening piece, one we’d written ourselves, and neither did anyone else from the suit-and-tie-wearing lunch crowd. Our error was immediately apparent: If you’re going to halt a fast-moving crowd hell-bent on to-go meals, you’ve got to hit ’em with something they know. Like Dylan’s “Knockin’ On Heaven’s Door,” which at least inspired some teenagers to interview us for their school newspaper. Our follow-up, however—an admittedly butchered version of Tom Petty and the Heartbreakers’ “Mary Jane’s Last Dance”—only inspired grimaces from the MallRide crowd.

Mercifully, a few familiar faces from 5280 rolled up and requested an original. As we belted out “Dear Jane Letter, I Just Need Time,” we discovered our most profitable lesson from the street: a small crowd begets a larger one. And larger crowds mean cash. An hour later, Action’s fingers were bloody from an enthusiastically improvised blues standard that would’ve made Muddy Waters proud, and my voice was shot, but we’d netted $13—which equaled about minimum wage for the pair of us. At times in my life, I’ve been homeless (it’s a long story), and in those days, I would’ve considered $13 a damn good start (and so might other buskers, who told me they make $50 to $100 in a few hours on a good day). Nowadays, it might not quite cover dinner for two, but it does buy at least a couple of pints, which in this beer-loving city almost qualifies as supper. —Brian Roundtree

Spending Diary 1

How Denverites spend those hard-earned greenbacks.

Wednesday, June 25

Returned from multiday business meeting in Bermuda to Denver via JFK and Salt Lake City

$26.95 Delta Airlines: Gogo in-flight Internet service

$20.23 French Meadow Bakery, Salt Lake City International Airport: two bottles of kombucha, one bottle of Naked orange juice, one antioxidant granola/nut mix

$70 Uber: car service from DIA to Congress Park

Thursday, June 26

No expenses; home sick

Friday, June 27

$60.03 King Soopers gas station: fueling up the VW camper before a weekend trip to Steamboat Springs for a wedding

$52.29 Whole Foods Market: ingredients for enchiladas

Saturday, June 28

$21.32 Locals Liquors, Silverthorne: beers for hanging out by the river en route to Steamboat

$18 Aurum Food & Wine, Steamboat Springs: beers while playing cornhole next to the river with our Bernese mountain dog, Wolfgang

$14.25 Brooklynn’s Pizzeria, Steamboat Springs: late-night slices after a wedding rehearsal event

$166.36 Sheraton Steamboat Resort: accommodations during weekend

Sunday, June 29

$79.26 Ski Haus Liquors: Russian River Supplication and Trinity sour beers to give to a friend (these beers typically sell out right away on the Front Range)

$39.18 Backcountry Delicatessen, Steamboat Springs: sandwiches for lunch with girlfriend

Monday, June 30

$51.53 Western Convenience, Steamboat Springs: filling up before heading home

$146.35 Whole Foods Market: stocked up on food after being out of town for a week

Tuesday, July 1

$170 City of Denver: check for speeding ticket in construction zone on return trip from mountain bike ride in Golden

$6 Pepsi Center: parking for work

TOTAL: $941.75

Spending Diary 2

Friday, June 20

Friday, June 20

$21.94 USPS: mailing Kickstarter gifts to supporters of You & Me Europe’s campaign

$101.22 FedEx: mailing Kickstarter gifts to supporters of You & Me Europe’s campaign

$50 Go Fund Me: donation for Denver’s Narrators’ Westward Expansion, a monthly storytelling show

$15 Summit Music Hall: whiskey drinks at The Knew, White Reapers, and Young Widows show

Saturday, June 21

Traveled to Reno, Nevada, for sister’s birthday

$2.10 Millcreek Coffee, Salt Lake City airport: tea

$20.47 Pneumatic Diner, Reno: vegan bubba split

$23.75 Taxi: from airport to Outlet at Legends mall in Sparks, Nevada

$4.30 FreshBerry: frozen yogurt

$69.85 BJ’s Restaurant and Brewhouse: sister’s birthday dinner

$22.30 Taxi: ride to sister’s house

Sunday, June 22

$92.19 Whole Foods Market, Reno: groceries for visit

$30.25 Taxi: ride to Outlet at Legends mall for shopping spree with sister

$132.29 Gifts for sister: shorts, bags, tank tops

Monday, June 23

$89.30 Kmart, Reno: clothes for younger brother

$45.67 Great Full Gardens Cafe, Reno: lunch

$8.40 Jamba Juice, McCarran International Airport, Las Vegas: Protein Berry Workout Smoothie with extra blueberries and peanut butter

Tuesday, June 24

$30 Indiegogo: donation for Boulder-based Language of Fish Collective Arts’ contemporary dance production Skeleton Woman

$79.05 Sprouts: groceries for the week

Wednesday, June 25

$145 Four Flowers Oriental Medicine: two acupuncture sessions plus ginseng pills

Thursday, June 26

No expenses

Friday, June 27

$543 LoDo Dental: crown

TOTAL: $1,526.08

Spending Diary 3

Friday, June 20

$2.25 RTD: light rail to the Western States Arts Federation Music Task Force meeting at Scum of the Earth Church

$10 Colorado Public Radio: monthly donation

Saturday, June 21

$2.25 RTD: bus to the Westword Music Festival in the Golden Triangle

$2 Curious Theatre: water at Poet’s Row, Glowing House, and A. Tom Collins show

$5 Westword Music Festival: Coors at King Kahn and the Shrines show

$5 Broadways: Breckenridge beer while emceeing a Magic Cyclops, Colfax Speed Queen, and the Drunken Cuddle show

$8 100% de Agave: tacos, chips, and salsa while watching Lil’ Thunder and Andy Thomas show

$4 Rooster and Moon Coffee Pub: Great Divide beer during Somerset Catalog show

$7 Uber: car service home

Sunday, June 22

$10 Illegal Pete’s: two breakfast burritos, chips,

and guacamole

$22 Divino Wine & Spirits: two bottles of rosé

Monday, June 23

$3 Metropolis Coffee: iced Americano

$28 Twist & Shout: used records

Tuesday, June 24

$12 Pizza Republica: preshow happy hour meal of wood-fired flatbread and red wine

$8 Buell Theatre: glass of wine during Nick Cave show

Wednesday, June 25

$3 Bardo Coffee House: meeting with Chris Zacher of Ruby Hill’s Levitt Pavilion

$75 MCA Denver: dual membership renewal fee

$8 The Source: loaves from Babettes Artisan Bread

$28 Alamo Drafthouse: two movie tickets and two drinks

Thursday, June 26

Ark Life plays the Westin in Beaver Creek

$48 Rupp’s Drums: drumhead and drum sticks

$3 Metropolis Coffee: coffee for the ride to Beaver Creek

$9 Avon Bakery & Deli: eggplant Parmesan sandwich

TOTAL: $302.50

Paycheck Breakdown

One local professional reveals how he diverts his monthly earnings—and Joe Clemens, co-founder of Denver’s Wisdom Wealth Strategies and adjunct instructor at the College for Financial Planning, weighs in on how he’s doing, starting with his monthly take-home pay.

—Sarah Ford

Mountain Math

How to afford a Summit County ski weekend without going broke.

Lodging: First things first: If you really want to save, make it a ski weekday, not weekend. While peak rates can soar well north of $200 per night on Saturdays and Sundays, you can snag ski-in/ski-out hotel rooms from $145 midweek. If you’re going with out-of-towners who don’t have season passes, consider going in on a bundled stay-and-play package. Or do as the Euros do and hostel it; the Fireside Inn, just off Breckenridge’s Main Street, offers dorm-style sleeping in a quaint Victorian for just $33 and up per night. Another option: Explore the world beyond Breck. Less-frequented resorts such as Leadville’s Ski Cooper don’t have the same cachet as the bigger resorts—but they also come with a smaller price tag.

Lift Pass: The very best deals often come at the end of the previous season (so you’re too late this year), but you can still score big discounts if you buy your pass before the resorts open. We won’t try to talk you into any one pass because we know everyone already has a favorite mountain. But we will try to convince you to follow your faves on social media so you don’t miss flash sales. (Buying your pass online is often cheaper than in person, with the notable exception of a few Labor Day sales.)

Lift Pass: The very best deals often come at the end of the previous season (so you’re too late this year), but you can still score big discounts if you buy your pass before the resorts open. We won’t try to talk you into any one pass because we know everyone already has a favorite mountain. But we will try to convince you to follow your faves on social media so you don’t miss flash sales. (Buying your pass online is often cheaper than in person, with the notable exception of a few Labor Day sales.)

Gear: Speaking of Labor Day sales…whether you’re replacing those scratched-up goggles or getting totally outfitted, Sniagrab (Sports Authority), Ski Rex (Colorado Ski & Golf), and Powder Daze (Christy Sports) are among the best places to pick up sweet new gear for cheap. (A couple of years ago, we scored our Salomon boots for less than $100.) Don’t panic if you miss these sales, though; the Denver Ski & Snowboard Expo (November 7 to 9) presents another chance to get deep discounts. Beginners: Remember that rental shops typically turn over gear every three years, so they’ll be looking to unload older stuff at the end of the season in the spring. Just ask the shop’s staff about rental resales when you go in.

Gas: If you figure it costs about 56 cents per mile in gas and maintenance to drive (as the IRS does), your round-trip visit to, say, Breck, costs you roughly $91—to say nothing of the swear-inducing traffic along I-70. There’s not much help for that—unless you’re headed to Eldora, which is the only Colorado resort that can be reached on RTD (take the B to Boulder and catch the Ski-n-Ride bus)—but you can at least save a buck (and some stress) with online car-pool bulletin boards such as skicarpool.org and theskilift.org. Just, you know, be careful whom you climb into a car with. If you’re going midweek, the forthcoming CDOT mountain bus is an option. The new route, estimated to start in the first quarter of 2015, will run from Glenwood Springs to Union Station and back, Monday through Friday, stopping in Eagle, Vail, Frisco, and Denver’s Federal Center along the way. Ticket prices have not yet been determined.

Meals: Ask about discounts for season pass holders at resort restaurants (most offer them). If you’re planning to stay on the mountain, look for lodging that includes breakfast in the price. And if you’re dining out, eat off the bar menu instead of the more expensive dining room option. Also look for happy hour deals that include food. In Breckenridge, Mi Casa’s happy hour starts at 3 p.m. and includes free chips and salsa. Complimentary nachos come out at 5, but if the grub’s all gone when you arrive, don’t panic; they usually restock every hour. And on Wednesdays you can score a burger at Ollie’s for just $2 (extra toppings not included). —KC

A Pile Of Money

That’s what we figured we’d need to pick up mountain real estate, but a closer look at some of the most popular ski towns proved otherwise, especially if you can be flexible about size. Here, details on what $300,000 gets you in 10 high-country spots—and what you’ll need when that’s not enough. —JWJ

Breckenridge and Frisco: You’ll have to spend north of $700,000 for a home in Frisco, but (surprisingly) just $300,000 in Breck.

Silverthorne: Well-appointed two-bedroom condos are available for $300,000, especially west and north of town, where a lot of ski resort and mill employees live. If you bump up your budget to $350,000, a single-family fixer-upper might be attainable.

Vail: All $300,000 gets you in this glam ski town is a small, dated condo—and those listings are scarce. If you want a sizable condo constructed this side of the Nixon era, you’re going to have to shell out at least $600,000.

Eagle: Just 30 minutes up the road from Vail, the market opens up. In Eagle, you can find 1,000- to 2,000-square-foot condos and townhomes (some with garages!) built within the last decade in the $300,000 range. You might even happen upon a few homes at that price.

Aspen: When we looked, we found one listing for $300,000: a 300-square-foot downtown studio. More livable condos here start at $400,000, but most single-family homes in town start at $2.4 million.

Telluride: With a $300,000 budget you can afford a one-bedroom ski condo in town or a 35-acre ranch 25 to 30 minutes outside of town, but for the latter, you’ll have to build your own house. In town, you’ll need $1 million to get into the single-family housing market.

Steamboat Springs: Condos in town or near the mountain area can go for $300,000, but homes aren’t a possibility at that price point—at least not here. They become feasible 25 miles west in Hayden or 20 miles south in Oak Creek.

Grand Lake: This might be the best deal in the mountains: $300,000 gets you a three-bedroom, two-bathroom, 1,500-square-foot cabin on a quarter-acre—with a view. Remember: Prices here may drop in the fall, as owners sometimes sell their cabins after enjoying them for the summer.

Crested Butte: A single-family home inside Crested Butte’s city limits will set you back $700,000; you’ll have to opt for a townhome 10 miles outside the charming downtown to slum it near the $300,000 mark.

High-Country Crunch

Summit County suffers from some of the highest health insurance rates in the country. Here’s why—and what’s being done to help.

In late 2013 and early 2014, when the vast majority of the Affordable Care Act kicked in, providing greater financial transparency about insurance rates, it also revealed a long-existing discrepancy in Colorado: Health insurance costs in the mountains were much higher than those along the Front Range. A 40-year-old in Summit County was paying nearly double ($483/month) the rate of a same-age Denverite ($280) for the same midlevel coverage.

In fact, Summit County residents paid the highest rate in America, along with residents of Eagle, Pitkin, and Garfield counties. Together, the four counties make up the “Mountain Resort Zone,” one of 11 health insurance zones Colorado established as part of the Affordable Care Act in 2013. Lack of competition among health-care providers accounts for part of the higher prices: Costs surge in rural areas because there are fewer doctors and hospitals, which means the existing ones can charge more for services. (Rates in other rural parts of the state, like the Eastern Plains, are also generally higher than along the Front Range.) It’s simple supply-and-demand economics. There’s also the fact that it costs more to get things into—and out of—remote areas. (A Kaiser Health News report found that insured Summit County residents pay 61 percent more than the state average for an inpatient hospital stay.) Rates of utilization come into play as well, and Summit County hospitals see a lot of visitors.

Fortunately, some relief is in sight. In 2015, the four-county Mountain Resort Zone will be eliminated. Insurance commissioner Marguerite Salazar redrew the map in May, uniting the Western Slope in a 22-county zone that aims to spread the burden of high-cost health care along the I-70 corridor. When insurance companies submitted preliminary 2015 rates for the commissioner’s scrutiny in late June, Summit County’s average rates were slated to drop, but rates among their newly bundled Western Slope neighbors, such as Steamboat Springs and Telluride, were set to rise.

There’s potentially more help in the future, especially if Kaiser Permanente, which earned nearly half of the customers who bought Colorado health exchange plans this year, expands into the mountains in 2016, as it recently announced it plans to do. That would increase the number of Western Slope health insurance providers (last year there were only six), creating more competition and therefore—one hopes—lower prices. (Denver, which has some of the lowest prices, boasted 12 insurance carriers in 2014.) And with the recent launch of Colorado’s All Payer Claims Database, consumers are now able to compare prices for an expanding list of medical procedures—such as knee and hip replacements—between every doctor and hospital across the state. So mountain residents will at least know whether it might be cheaper to opt for that knee reconstruction a little farther down the road; like, say, in the Mile High City. —Jennie Lay

Gear Closet

A confessed gear-junkie assesses the true value of her outdoor equipment. —Dana Pritts Smith